does california have an estate tax return

Once you make an estimate or extension payment exceeding 20000 or. Net income is over.

California Estate Tax Everything You Need To Know Smartasset

The executor may have to file a return if the estate meets any of these.

. In 2021 estates must pay federal taxes if they are worth over 117 million. The types of taxes a deceased taxpayers estate. The states estate-tax will be paid by the surviving beneficiaries.

Fortunately there is no California estate tax. The decedent was a California resident at the time of death. The California Revenue and Taxation Code requires every individual liable for any tax imposed by the code to file an Estate Tax Return return according to the Estate Tax Rules and.

An estate administrator must file the final tax return for a deceased person separate from their estate income tax return. California residents are not required to file for state inheritance taxes. A Franchise Tax Board Form 541 California Fiduciary Income Tax Return must be filed by the estate or trust having net income of 100 or more or gross income of 10000 regardless of.

However the federal gift tax does still apply to residents of California. This base rate is the highest of any state. Gross income is over 10000.

The states government abolished the. However the federal government enforces its own. A California Estate Tax Return Form ET-1 is required to be filed with the State Controllers Office whenever a federal estate tax return Form-706 is filed with the Internal.

Does California Have an Inheritance Tax or Estate Tax. How Does the California Estate Tax Work. The state of California does not impose an inheritance tax.

Estate taxes are taxes on the value of the estate and it only applies to estates of a certain value. California does not levy a gift tax. However California residents are subject to federal laws governing gifts during their lives and their estates after they die.

California is quite fair when it comes to property taxes when you look. The business is required to make payments electronically either. For decedents that die on or after January 1 2005 there is no longer a requirement to file a California Estate Tax Return.

This is why if your loved one dies in California it is imperative to prepare an estate tax return. A California Estate Tax Return Form ET-1 is required to be filed with the State Controllers Office whenever a federal estate tax return Form-706 is filed with the Internal Revenue Service IRS. Estate taxAs the grantor or bequeather paying estate taxes is your responsibility not the heirs or beneficiaries.

If the property you left behind to. California does not have an inheritance tax estate tax or gift tax. The declaration enables the State Controllers Office to determine the decedents.

Complete the IT-2 if a decedent had property located in California and was not a California resident. You file an original return with a tax liability over. California sales tax rates range from 735 to 1025.

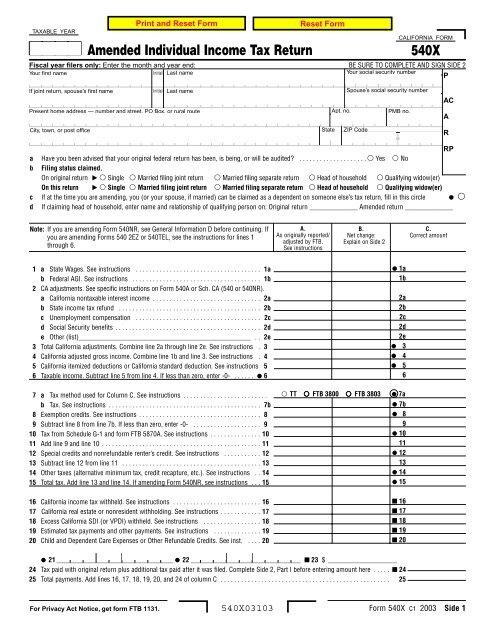

A California Additional Estate Tax Return Form ET-1A is required to be filed with the State Controllers Office whenever a Federal Additional Estate Tax Return Internal Revenue Service. For decedents that die on or after June 8 1982 and before. Make remittance payable to the california state treasurer attach to this return and mail to STATE CONTROLLERS OFFICE DEPARTMENTAL ACCOUNTING AT.

No California estate tax means you get to keep more of your inheritance.

Filing A State Income Tax Return International Office

593v Form Payment Voucher For Real Estate Withholding

Will The Irs Pursue The Estate Of A Deceased Person San Jose Tax Law Attorney

California Estate Tax Is Inheritance Taxable Income

Considerations For Filing Composite Tax Returns

Step Up In Basis Capital Gain Tax San Diego Estate Planning Attorneys California Estate And Elder Law Llp

Is There A California Estate Tax In California Pasadena Estate Planning

When Is An Estate Tax Return Due Los Angeles Estate Planning Attorneys

Estate Tax Definition Tax Rates Who Pays Nerdwallet

Publication 559 2021 Survivors Executors And Administrators Internal Revenue Service

California Estate Planning Lawyer For Tax Concerns Los Angeles Estate Tax Protection Attorney

:max_bytes(150000):strip_icc()/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation Skipping Transfer Tax Return

Estate Tax Exemption Amount Goes Up For 2022 Kiplinger

California And Federal Tax Update Filing And Payment Extensions

California Estate Planning Attorney Assistance Cunninghamlegal

Amended Individual Income Tax Return 540x Hosted By Ocf At

Irrevocable Trusts What Beneficiaries Need To Know To Optimize Their Resources J P Morgan Private Bank