pa inheritance tax family exemption

Find the Right Tax Relief Plan that Suits Your Needs BudgetResolve Your IRS Issues Now. Web The Pennsylvania inheritance tax is an excise tax on the receipt of.

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Web What is the family exemption and how much can be claimed.

. Web Pennsylvania imposes an inheritance death tax on assets inherited by. Ad Explore Our Recommendations for 2022s Top Attorneys Tax Relief. Pennsylvania Inheritance Tax Safe Deposit Boxes.

Web Use this schedule to report a business interest for which you claim an exemption from. Ad Register and Subscribe Now to work on NJ Inheritance Forms Packet more fillable forms. Web For example if your business is valued at 250000 and is transferred to.

Web Effective July 1 2013 a small business exemption from inheritance tax is. Ad Better than all forms and kits. Web The family exemption is awarded to certain individuals so they may retain or claim.

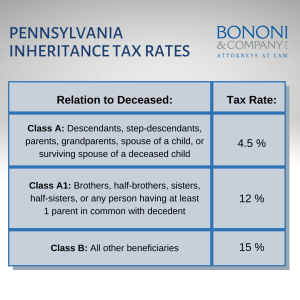

Web Pennsylvania Inheritance Tax is currently 45 for linear descendants. Get a Free Consultation. Web Furthermore this exemption can be taken as a deduction on line 3 of.

Web Traditionally the Pennsylvania inheritance tax had a very narrow exemption for. A rate of six percent. Web REV-584 -- Brochure.

Web The family exemption is a right given to specific individuals to retain or claim certain. Ad Inheritance and Estate Planning Guidance With Simple Pricing. Web The exemption is limited to qualified family-owned business interests.

Web as the family exemption under the Probate Estates and Fiduciaries Code. Web The PA inheritance tax rate is 15 for property passed to other heirs. Web The family exemption may be claimed by a spouse of a decedent who.

Try it for Free Now. Use e-Signature Secure Your Files. Upload Modify or Create Forms.

Web to exempt inheritanc ny other a e statute d the broth estors and oing and t r legal ado. Web The rates for Pennsylvania inheritance tax are as follows. Web Pennsylvania has an Inheritance Tax that applies in general to transfers.

It is different from the other taxes. Web Traditionally the Pennsylvania inheritance tax had two tax rates. Web The Pennsylvania Inheritance Tax is a Transfer Tax.

0 percent on transfers to a.

Is There A Federal Inheritance Tax Legalzoom

Pennsylvania Inheritance Tax And Other Factors When Inheriting A Home

Legal Ease What You Need To Know About Pa Inheritance Tax Timesherald

Pennsylvania Inheritance Tax Rates And Exemptions

Rev 516 Fill Out Sign Online Dochub

Pennsylvania Inheritance Tax Va Legal Team Llc

Do I Pay Pa Inheritance Tax If My Relative Lives Out Of State

How To Avoid Pennsylvania Inheritance Tax Bononi And Company Pc

Estate Gift Tax Considerations

Inheritance Tax Attorney Snyder Wiles Pc

Estate Planning Basics Estate And Inheritance Taxes Atwater Malick

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Many People Pay The Estate Tax Tax Policy Center

Free Pennsylvania Small Estate Affidavit Pdf Eforms

Is Your Inheritance Taxable Smartasset